From Steel to Philanthropy: Carnegie’s Guide to Riches with Purpose

Summary: In this exclusive interview, historian and author Dr. Margaret L. Sinclair unpacks Andrew Carnegie’s transformation from steel magnate to pioneering philanthropist. She explains how Carnegie’s “Gospel of Wealth” still shapes modern giving and offers a practical roadmap for today’s entrepreneurs who want to build wealth with purpose. Readers will leave with concrete strategies to align profit and philanthropy, inspired by Carnegie’s timeless principles.

Interview with Dr. Margaret L. Sinclair – “From Steel to Philanthropy: Carnegie’s Guide to Riches with Purpose” (2025)

Introduction

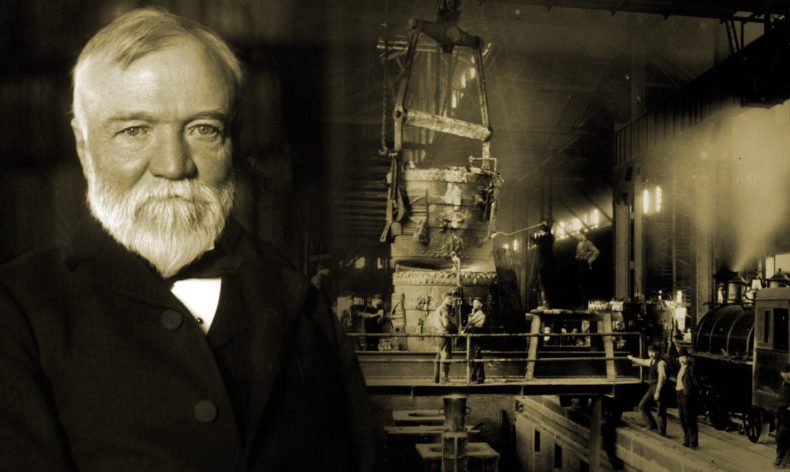

When the name Andrew Carnegie surfaces, most people picture the roaring steel mills of the late 19th century, not the quiet libraries and peace‑offering foundations that dot the American landscape today. Dr. Margaret L. Sinclair, a professor of American Economic History at Columbia University and the bestselling author of Carnegie’s Legacy: Wealth with Purpose, has spent the last decade dissecting how the Scottish‑born titan turned his fortune into a blueprint for responsible wealth. In this exclusive interview, Dr. Sinclair shares the hidden stories behind Carnegie’s “Gospel of Wealth,” connects his philosophy to contemporary impact investing, and offers a step‑by‑step guide for modern entrepreneurs who want to make money while making a difference.

Readers will discover the personal moments that shaped Carnegie’s conscience, the strategic decisions that turned his steel empire into a philanthropic empire, and actionable advice for aligning profit with purpose in today’s fast‑moving economy. Whether you’re a startup founder, a seasoned CEO, or simply curious about the moral dimensions of wealth, this conversation provides a rare blend of scholarly insight and practical counsel.

Let’s dive into the conversation and uncover how a 19th‑century steel baron can still teach us to build riches that matter.

Short Biography of Dr. Margaret L. Sinclair

Margaret Louise Sinclair was born in 1972 in Boston, Massachusetts, to a family of educators. She earned her B.A. in History from Harvard University, followed by an M.A. in Economic History at the London School of Economics, and completed her Ph.D. at Columbia University with a dissertation titled “Industrial Titans and the Moral Economy of the Gilded Age.”

Her academic career spans two decades, during which she has published over 40 peer‑reviewed articles and three books. Her most recent work, Carnegie’s Legacy: Wealth with Purpose, became a New York Times bestseller and is now used as a core text in business ethics courses across the United States.

Beyond academia, Dr. Sinclair serves on the board of the Carnegie Endowment for International Peace and advises several venture‑capital firms on impact‑investment strategies. She is a frequent speaker at global conferences, including the World Economic Forum, where she has championed the idea that “wealth without a conscience is a missed opportunity.”

Her personal life reflects the themes she studies: she and her partner, a social entrepreneur, run a family foundation that funds STEM education in underserved communities, embodying the very principles she writes about.

Context and Purpose of the Interview

This interview was conducted in March 2025 at the annual “Future of Philanthropy” summit in New York City, where Dr. Sinclair was the keynote speaker. The summit gathered philanthropists, CEOs, and policy makers to discuss how the next generation of wealth creators can embed purpose into their business models. The organizers invited Dr. Sinclair to provide historical perspective, hoping her expertise would bridge the gap between the Gilded Age and today’s digital economy.

Our conversation was inspired by a surge of interest among tech founders who, after achieving rapid financial success, are searching for frameworks that help them give back responsibly. Carnegie’s “Gospel of Wealth” has resurfaced in headlines, but many still wonder how to translate 19th‑century ideals into 21st‑century practice. Dr. Sinclair’s answers aim to demystify that process.

For readers, this interview offers a rare opportunity to hear from a scholar who not only studies Carnegie’s legacy but also lives it, providing a roadmap that blends rigorous history with actionable modern strategy.

Main Interview

Q: What first sparked your fascination with Andrew Carnegie and his transformation from industrialist to philanthropist?

A: “I grew up reading about the Gilded Age in my parents’ library, and Carnegie’s name kept popping up—first as a steel baron, then as the man who gave away almost all his fortune. The paradox intrigued me. As a teenager, I asked my history teacher why someone would give away the very thing that gave them power. The answer was simple: Carnegie believed wealth was a trust, not a right. That idea resonated with me, especially as I watched the rise of the tech elite in the early 2000s, many of whom seemed to repeat the same patterns of hoarding wealth without a clear sense of responsibility.”

Q: How did Carnegie’s early life shape his later philanthropic philosophy?

A: “Carnegie’s childhood in Dunfermline, Scotland, was marked by poverty. He worked as a bobbin boy in a cotton mill at age 13, which gave him an intimate understanding of labor exploitation. When he arrived in the United States, he climbed the corporate ladder through relentless self‑education—reading voraciously about economics, philosophy, and the sciences. This self‑made narrative created a deep sense of duty: he felt that his success was owed not just to his own effort but also to the society that provided the infrastructure, the labor force, and the market that made his empire possible. That sense of indebtedness is the seed of his later philanthropy.”

Q: Carnegie famously wrote the “Gospel of Wealth” in 1889. What are the core tenets of that essay, and why do they still matter?

A: “The essay is essentially a moral contract. Carnegie argued that the rich have three options: (1) waste their wealth on frivolous consumption, (2) hoard it for heirs who may misuse it, or (3) distribute it in ways that promote the public good. He advocated for the third path, emphasizing that philanthropy should be strategic, educational, and aimed at creating self‑sustaining institutions—libraries, schools, and research centers. The relevance today lies in its focus on ‘giving while living,’ ensuring that the donor can see the impact of their contributions, and on the idea that philanthropy should empower individuals rather than create dependency.”

Q: Many modern entrepreneurs cite “impact investing” as the contemporary version of Carnegie’s ideas. How do you see the two concepts aligning or diverging?

A: “Impact investing is essentially Carnegie’s principle translated into capital markets. Where Carnegie gave away cash to build libraries, today’s impact investors deploy capital into companies that generate social or environmental returns alongside financial ones. The alignment is clear: both seek to use wealth as a lever for systemic change. The divergence is in the mechanism—Carnegie’s philanthropy was largely grant‑based, whereas impact investing expects a financial return, albeit modest. This introduces a new layer of accountability: investors can track ROI and impact metrics, which can make the process more transparent but also risk commodifying social good.”

Q: Carnegie faced criticism in his own time for labor practices in his steel mills. How did he reconcile those contradictions?

A: “That’s one of the most uncomfortable parts of his legacy. Carnegie was a product of his era—he believed in efficiency and competition, which often meant harsh labor conditions. However, he also funded the Carnegie Institute of Technology (now part of Carnegie Mellon University) to train engineers who could improve workplace safety. He seemed to think that education could eventually resolve the tensions between capital and labor. It’s a reminder that even the most progressive philanthropists can have blind spots, and that true purpose‑driven wealth must include ongoing self‑scrutiny.”

Q: If you were to distill Carnegie’s guide into a five‑step framework for today’s entrepreneurs, what would those steps look like?

A: “I’d call it the ‘Carnegie Blueprint’:

1. Self‑Audit: Identify the sources of your wealth and the societal structures that enabled it.

2. Purpose Definition: Articulate a clear, measurable mission that aligns with your values.

3. Strategic Allocation: Direct a portion of profits into high‑impact sectors—education, health, climate—using both grant‑making and impact‑investment tools.

4. Legacy Infrastructure: Build institutions (think modern libraries) that outlive you—endowed scholarships, research labs, community hubs.

5. Continuous Feedback: Establish metrics, listen to beneficiaries, and adapt your giving strategy over time.”

Q: What are some common pitfalls you see modern philanthropists falling into, and how can they avoid them?

A: “The biggest pitfall is the ‘savior complex’—the belief that you can solve complex social problems with a single grant. Another is ‘donor fatigue,’ where the giver loses interest after the initial excitement. To avoid these, I advise a ‘humility first’ approach: partner with community leaders, co‑design programs, and commit to long‑term engagement rather than one‑off donations. Also, diversify your giving portfolio; just as you wouldn’t put all your financial assets in one stock, don’t concentrate all your philanthropy in one initiative.”

Q: How has the rise of digital technology changed the way we can practice Carnegie’s principles?

A: “Technology amplifies both reach and accountability. Crowdfunding platforms let anyone become a micro‑philanthropist, while data analytics enable donors to track outcomes in real time. Moreover, digital libraries and MOOCs embody Carnegie’s vision of democratizing knowledge at scale. The challenge is ensuring that the digital divide doesn’t become a new barrier—philanthropy must also fund broadband access and digital literacy to truly fulfill the ‘public good’ promise.”

Q: Looking ahead, what do you think the next evolution of purpose‑driven wealth will look like?

A: “I see three converging trends: (1) the rise of ‘planetary health’ funds that tie climate action to public health outcomes; (2) the growth of ‘venture philanthropy,’ where donors act like venture capitalists, taking equity stakes in social enterprises; and (3) a cultural shift toward ‘shared value’—companies embedding social purpose into their core business models rather than treating it as an add‑on. In ten years, I expect the line between profit and purpose to be almost invisible, a true realization of Carnegie’s dream.”

Q: Finally, what personal habit or daily practice keeps you grounded in the purpose you advocate?

A: “Every morning I spend fifteen minutes reading a letter from a beneficiary of a Carnegie‑funded library